Can Capital Gains Push Me Into a Higher Tax Bracket?

Learn how capital gains are taxed and how to avoid paying more taxes than necessary when selling your assets.

As an investor, you likely know that long-term capital gains (gains on assets such as stocks, bonds, shares in mutual funds and exchange-traded funds (ETFs), as well as rental properties, cottages, and business assets, equipment held for over one year) are taxed at a lower rate than ordinary income taxes.

What you may not know is whether these gains will cause your wages, dividends, RRIF, LIFF, or pension withdrawals to be taxed at a higher rate. Will the capital gain actually make you keep less of your hard-earned money?

Selling your high-performing stocks (congrats on buying Amazon in 1995!) or your cottage during COVID can reap significant profits, and those moments are worth celebrating.

But while you’re enjoying the profits of your investments and impeccable timing, keep in mind that you’ll eventually have to pay tax on them.

In Canada, most gains on capital assets are taxed. Most, but not all. Notice that insurance and cash values inside a properly structured dividend-paying whole life policy were NOT mentioned above, as these assets are not taxed (neither as capital gains and/or income) when set up properly.

We will talk more about that later...

For now, let’s look at other strategies to avoid paying more taxes than you need to come tax time.

Capital Gains: two words that can prompt both elation and anger. You made money, it’s time to celebrate! But now you owe the government on those earnings, and that can hurt.

There are any number of reasons to take capital gains. Maybe you're coordinating retirement withdrawals or you want to use those gains for a large purchase. After all, one of the reasons taxes are lower on long-term capital gains is to encourage investors to spend that money now instead of in the future. Whatever your reason, before you take those capital gains it's important to understand how it affects your tax burden.

Bad news first: Capital gains will drive up your Total Income on line 150. As this amount increases, you begin to get phased out of certain itemized deductions, several tax credits, and lose your eligibility for certain grants and loans (for example student loans and bursaries), and could lose your small business benefits (if you are making more than $50K of passive income inside your INC, your taxes can significantly increase).

And now, the good news: long-term capital gains are taxed separately from your ordinary income, and your ordinary income is taxed FIRST. In other words, long-term capital gains and dividends which are taxed at the lower rates WILL NOT push your ordinary income into a higher tax bracket. The main difference is that the gains are taxed differently depending on whether they're short-term or long-term – short-term gains (gains acquired in less than a year such as day trading and flipping homes) are included in your ordinary income and therefore are taxed at ordinary income rates.

Let's repeat: LONG-TERM CAPITAL GAINS WILL NOT CAUSE YOUR ORDINARY INCOME TO BE TAXED AT A HIGHER RATE! This is good news, but that's not all: if you know how to navigate the tax code, taking long-term capital gains can also open up a number of tax planning opportunities.

Contrary to popular belief, capital gains are not taxed at a set rate of 50%, nor are they taxed in their entirety at your marginal tax rate. Rather, only half (50%) of the capital gain on any given sale is taxed at your marginal tax rate (which varies by province).

On a capital gain of $100,000, for instance, only half of that amount, $50,000, is taxable.

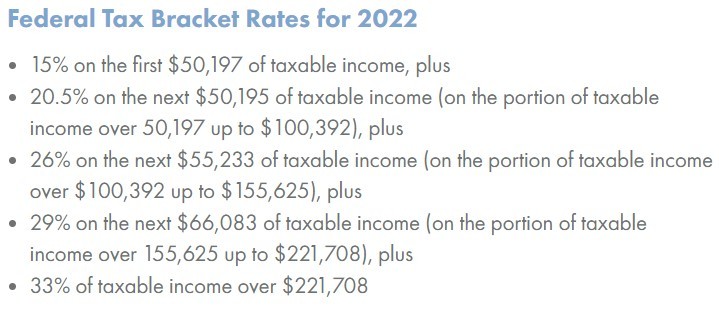

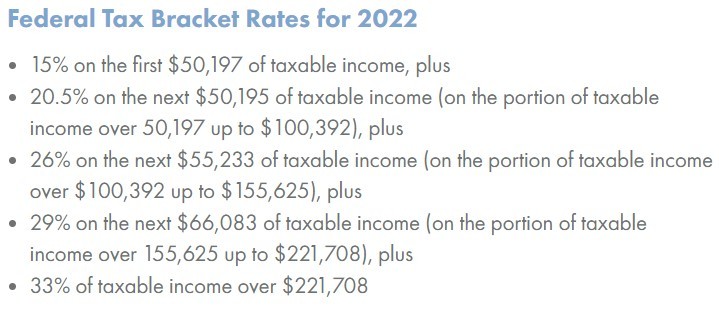

And the tax rate depends on your income. For the average Canadian family who makes $91,535 (I know you are not average😉) who lives in Nova Scotia (the province with the highest tax rates) falls into a 31.5% marginal tax rate, paying the governments $28,851.

Capital Gains and Ordinary Income Tax

Capital Gains: two words that can prompt both elation and anger. You made money, it’s time to celebrate! But now you owe the government on those earnings, and that can hurt.

There are any number of reasons to take capital gains. Maybe you're coordinating retirement withdrawals or you want to use those gains for a large purchase. After all, one of the reasons taxes are lower on long-term capital gains is to encourage investors to spend that money now instead of in the future. Whatever your reason, before you take those capital gains it's important to understand how it affects your tax burden.

Bad news first: Capital gains will drive up your Total Income on line 150. As this amount increases, you begin to get phased out of certain itemized deductions, several tax credits, and lose your eligibility for certain grants and loans (for example student loans and bursaries), and could lose your small business benefits (if you are making more than $50K of passive income inside your INC, your taxes can significantly increase).

And now, the good news: long-term capital gains are taxed separately from your ordinary income, and your ordinary income is taxed FIRST. In other words, long-term capital gains and dividends which are taxed at the lower rates WILL NOT push your ordinary income into a higher tax bracket. The main difference is that the gains are taxed differently depending on whether they're short-term or long-term – short-term gains (gains acquired in less than a year such as day trading and flipping homes) are included in your ordinary income and therefore are taxed at ordinary income rates.

Let's repeat: LONG-TERM CAPITAL GAINS WILL NOT CAUSE YOUR ORDINARY INCOME TO BE TAXED AT A HIGHER RATE! This is good news, but that's not all: if you know how to navigate the tax code, taking long-term capital gains can also open up a number of tax planning opportunities.

How are capital gains taxed in Canada?

Contrary to popular belief, capital gains are not taxed at a set rate of 50%, nor are they taxed in their entirety at your marginal tax rate. Rather, only half (50%) of the capital gain on any given sale is taxed at your marginal tax rate (which varies by province).

On a capital gain of $100,000, for instance, only half of that amount, $50,000, is taxable.

And the tax rate depends on your income. For the average Canadian family who makes $91,535 (I know you are not average😉) who lives in Nova Scotia (the province with the highest tax rates) falls into a 31.5% marginal tax rate, paying the governments $28,851.

This simple calculation with StudioTax software and the rates above, a little more work with old fashion paper and pen - roughly 26.9% on the first $50,197 and approx 37.2% on the remaining $41,338),

This same family had a capital gain of $100,000, which only half of that amount, $50,000, is taxable. The majority capital gain of this $50,000 would then be taxed at the next tax brackets (Federally at 26% and provincially at 17.5% or 43.5%) owing $21,750. The remaining $78,250 is the investor’s to keep.

Using the above example, the family paid $28,851+$21,750 = $50,601 in taxes on the total $191,535 income they made. Their marginal tax rate would now be 26.4%

TANGENT ALERT: I once compared my marginal tax rate when I moved back to Nova Scotia from when I lived in Alberta. Don't do that. It will only make you angry, especially if you share my belief that taxes on your investments after already paying income tax should be illegal and that taxes are a major reason why most won't reach financial independence.

How to Calculate Capital Gains

To calculate the capital gain or loss on recently sold assets, such as property or stocks, you’ll need the following details, according to the Canada Revenue Agency (CRA):

Proceeds of disposition: The value of the asset at the time of sale

This same family had a capital gain of $100,000, which only half of that amount, $50,000, is taxable. The majority capital gain of this $50,000 would then be taxed at the next tax brackets (Federally at 26% and provincially at 17.5% or 43.5%) owing $21,750. The remaining $78,250 is the investor’s to keep.

Using the above example, the family paid $28,851+$21,750 = $50,601 in taxes on the total $191,535 income they made. Their marginal tax rate would now be 26.4%

TANGENT ALERT: I once compared my marginal tax rate when I moved back to Nova Scotia from when I lived in Alberta. Don't do that. It will only make you angry, especially if you share my belief that taxes on your investments after already paying income tax should be illegal and that taxes are a major reason why most won't reach financial independence.

How to Calculate Capital Gains

To calculate the capital gain or loss on recently sold assets, such as property or stocks, you’ll need the following details, according to the Canada Revenue Agency (CRA):

Proceeds of disposition: The value of the asset at the time of sale

Adjusted cost base (ACB): The amount originally paid

Outlays and expenses: Total of costs deemed necessary before selling, such as renovations and maintenance expenses, finders’ fees, commissions, brokers’ fees, surveyors’ fees, legal fees, transfer taxes and advertising costs

Once you have those three numbers in hand, you can calculate the capital gain by subtracting the ACB and outlays and expenses from the proceeds of disposition.

Proceeds of disposition – (ACB + outlays and expenses) = capital gain

Once you have those three numbers in hand, you can calculate the capital gain by subtracting the ACB and outlays and expenses from the proceeds of disposition.

Proceeds of disposition – (ACB + outlays and expenses) = capital gain

Tax Planning Opportunities When You Properly Coordinate Capital Gains and Ordinary Income

A capital gain is taxed only once it is “realized,” meaning the asset has been sold. As long as the gain is “unrealized,” meaning the asset’s value has increased on paper but the asset remains in your possession, you do not have to pay taxes on it. One strategy to reduce the amount of tax is to time the sale of the asset for a period when your income will be lower—for example, when you’re retired or on leave from work. (Do you really think taxes will be lower when you retire - AND, who's kidding who, are you ever going to retire?)

Understanding the relationship between capital gains and ordinary income taxes – and the order in which they're taxed – can open up a wide range of tax planning opportunities. These opportunities may be available in the following scenarios:

- You are a consultant or own a business

- You are temporarily unemployed

- You work in sales and your salary varies from year to year

- You are between 55 and 70, and you are looking to either transition into retirement or you are already retired

What's the Point?

Maybe you still have some questions about how capital gains are taxed compared to ordinary income.

Maybe you're considering whether an RRSP, TFSA, or use the Smith Manoeurve is the best way to invest.

Maybe you're wondering if it is even worthwhile to invest your hard-earned money.

Or maybe, just maybe, you're looking for a way to grow, protect, and keep your money without having to pay capital gains, tax, or unexpected loss...

If you are interested in our value-based financial services and have more than $250,000 of investible assets (excluding real estate), click the picture below to schedule an introductory call to find out if our expertise and services match your needs.

We are here to help those that help others

Sources:

Canada.ca

CRA - Captial Gains

MoneySense.ca

Quarryhilladvisors.com

Michael Kitces

Years and Years of research and experience - looking under every rock and doing a deep dive into numerous financial products and strategies.

Comments

Post a Comment